Stock Market Analysis: Nifty 50 Outlook, India VIX Insights, and Expert Stock Recommendations for Friday Trading

Despite robust activity in banking stocks, the Indian stock market faced its fifth consecutive session of decline on Thursday. The Nifty 50 index recorded a loss of 216 points, closing at 22,488, while the BSE Sensex dropped by 617 points to conclude at 73,885. On the other hand, the Bank Nifty index experienced an increase of 181 points, ending the day at 48,682. In broader market movements, the mid-cap index witnessed a decline of 1.21 percent, while the small-cap index plummeted by 1.33 percent.

Trade Setup for Friday:

Rupak De, Senior Technical Analyst at LKP Securities, observed that the Nifty 50 index displayed volatility with a prevailing bearish sentiment. De emphasized the importance of the index sustaining above the critical 21-day Exponential Moving Average (21EMA) at 22,500 for a substantial recovery. Conversely, failure to surpass this level may attract renewed selling pressure, potentially driving the index towards 22,300/22,100.

Neeraj Sharma, AVP Technical and Derivatives Research at Asit C Mehta, provided insights on the Bank Nifty’s performance, highlighting a positive trajectory following a robust recovery. Sharma outlined key resistance levels at 49,000-49,050, suggesting a potential rally towards 49,690 and 50,000 upon sustained levels above 49,050.

Market Outlook:

Siddhartha Khemka, Head of Retail Research at Motilal Oswal, expressed apprehension amidst pre-election nervousness and global uncertainties, foreseeing heightened market volatility leading up to the election outcome.

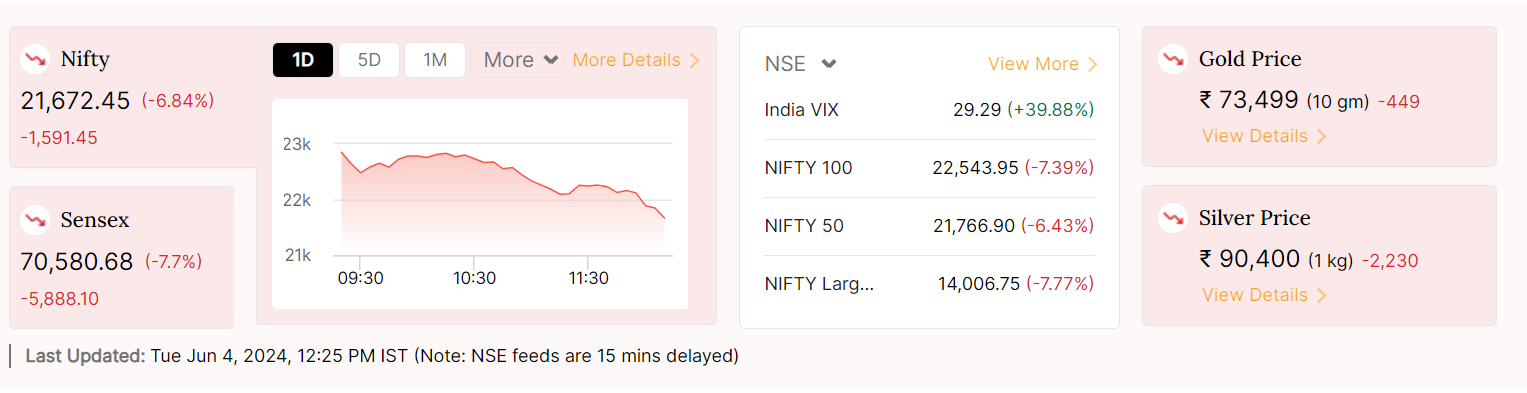

Sumeet Bagadia, Executive Director at Choice Broking, discussed the India VIX Index’s upward movement, signaling increased market volatility. Bagadia anticipated further volatility upon breaching the resistance level at 25, potentially reaching 28 in the near term.

Top Stock Recommendations:

Expert analysts Sumeet Bagadia and Ganesh Dongre, Senior Manager of Technical Research at Anand Rathi, provided buy or sell recommendations for five prominent stocks:

Sumeet Bagadia’s Picks:

- Dixon Technologies: Buy at ₹9308, target ₹9900, stop loss ₹9000.

- Ujjivan Small Finance Bank: Buy at ₹589.50, target ₹630, stop loss ₹568.

Ganesh Dongre’s Recommendations: 3. PNB Housing Finance: Buy at ₹748, target ₹780, stop loss ₹720. 4. BEL: Buy at ₹290, target ₹305, stop loss ₹282. 5. Escorts: Buy at ₹3856, target ₹4050, stop loss ₹3780.

Nifty 50 and Sensex Today: Anticipating Indian Stock Market Trends for May 31 Trading

Expectations are high for a positive opening in the Indian stock market on Friday, with both the benchmark indices, Sensex and Nifty 50, likely to commence trading on an upward trajectory. This optimism comes amid a mixed bag of signals from global markets.

The outlook for the Gift Nifty also mirrors this positive sentiment, suggesting a favorable start for the Indian benchmark index. Currently hovering around the 22,690 mark, the Gift Nifty indicates a premium of approximately 60 points compared to the previous close of Nifty futures.

Thursday witnessed a significant downturn in the domestic equity indices, marking the fifth consecutive session of losses, primarily attributed to the monthly F&O expiry.

The Sensex witnessed a steep decline of 617.30 points, settling at 73,885.60, while the Nifty 50 closed 216.05 points, or 0.95%, lower at 22,488.65.

Analyzing the Nifty 50’s performance, it formed a bearish candlestick pattern characterized by upper and lower shadows on the daily timeframe.