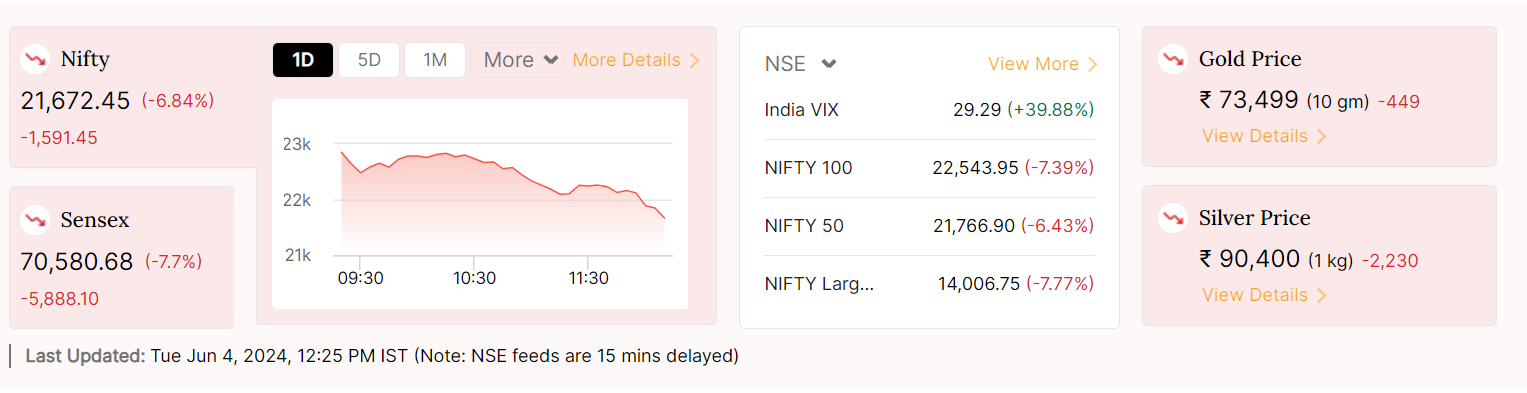

Election Results 2024 Sensex Crash Live Updates: Indices witnessed their worst fall since March 2020, erasing all Monday’s gains after exit polls projected that the BJP-led alliance was likely to get a two-thirds majority in the House.

Television channels showed the ruling National Democratic Alliance ahead by nearly 300 seats. 272 seats is the minimum required to get a simple majority in the 543-member House of Representatives.

The volatility index rose to its highest level since March 2022 at 29.79 after a decline on Monday.

“Since exit polls are at the extremes, anything that does not indicate further strength is clearly negative,” said Anand James, chief market strategist at Geojit Financial.

James said: “Despite the elections showing a landslide victory for the ruling party, the market volatility measure did not drop below 20 as pricing in extremes.”

All sectors were in the red zone. Banking stocks fell 7.8%, real estate tumbled 9.1%, infrastructure stocks tumbled 10.5%, while oil and gas stocks tumbled 11.7%, and shares of state-run companies and banks fell 17% and 16%, respectively.

Adani Enterprises and Adani Ports were the top losers in the Nifty 50 index, falling 19% each. Other Adani Group stocks fell between 9% and 19%. The group’s stocks rallied between 4% and 18% on Monday following the opinion polls.

Mayuresh Joshi, Lead India Equity Research Expert at William O. “Neil & Co”

“Markets were at all-time highs, a lot of expectations were built (on a BJP majority) and these expectations will fade in the next few sessions and the focus will shift to policy announcements as any form of reforms will continue with the BJP getting the nod.” “Carte blanche,” Joshi said.

Asian stock markets fell on Tuesday as global investors awaited the results of official elections in India and considered the possibility that the “exceptionalism” of the US economy is starting to wane as manufacturing activity there weakens.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.4%, after US stocks ended the previous session with a modest gain. The index has risen 2.1% so far this month.

Australian shares fell 0.15%, while the Japanese Nikkei stock index fell 0.11%.

Hong Kong’s Hang Seng rose 0.33% after initially opening in negative territory, and China’s CSI300 gained 0.23%.

In early European trade, Euro Stoxx 50 futures fell 0.1% to 5,007, German DAX futures fell 0.21% to 18,615 and FTSE futures fell 0.09% to 8,265.5.

US stock futures, S&P 500 e-minis, rose 0.01% to 5,297.8.

The strength of the U.S. labor market will be closely watched over the new few days, with the release of the Job Opportunities and Labor Turnover Survey (JOLTS) later on Tuesday. May nonfarm payroll numbers will be published on Friday.

“We expect a modest decline in labor demand in the U.S. market,” said Raisa Rashid, global market analyst at JPMorgan Asset Management.

“What does this mean for the Fed? I think all the data points to a rate cut later in the year, probably in December. If the data moves in a different direction than expected, that cut could be extended to September.”

In Hong Kong, the city’s mainland Hang Seng property index rose 2.5% after a research note from Citigroup raised price targets for the 23 Chinese real estate companies it covers.

“We are starting to see more greenery in China, especially after the measures and incentives for the real estate sector,” said David Chow, global market strategist at Invesco Asia Pacific.

“Further action is expected. This helps develop given the environment in Asia, emerging markets in Asia and the risk in stocks compared to bonds. I think the recent market rally we’ve seen has a lot more to recover from.”

The yield on the benchmark 10-year Treasury note rose to 4.4099% compared with its US 4.402% on Monday. The two-year yield, which rises as traders expect higher fed funds rates, rose to 4.8245% compared with its US 4.818%.

US Treasury yields fell to their lowest level in two weeks on Monday, after the country’s manufacturing activity fell for a second consecutive month in May.

The two-year bond yield fell 6 basis points, while the 10-year bond yield fell 11 basis points.

US crude fell 0.88 per cent to $73.57 a barrel. Brent crude fell to $77.77 a barrel. Both benchmarks fell to their lowest in four months on Monday after the Organization of Petroleum Exporting Countries and its allies, known as OPEC, agreed to ease some production cuts starting in October.

04 Jun 2024, 12:13:15 PM IST

Election Results 2024 Sensex Breakdown Live Updates: Heatmap of sector indices

Election Results 2024 Sensex Breakdown Live Updates: Across sectors, the PSU bank index fell over 17%, followed by oil and gas, metals, real estate, financial services and banking indices by over 8%.

Election Results 2024 Stock Market Impact Live: 12pm Market Updates

Election Results 2024 Stock Market Impact Live: With early trends showing lesser margin between constituencies led by the BJP-led NDA and the Congress-led INDI alliance, Indian benchmark indices extended their losses further on Tuesday.

At 12 noon, the Sensex was down 4,252.50 points, or 5.56%, at 72,216.28 and the Nifty was down 1,319.35 points, or 5.67%, at 21,944.55.

Election Results 2024 Sensex Crash Live Updates: Avendus Capital Public Markets Alternate Strategies CEO Andrew Holland says market confidence has been shaken; Investors will wait and see what happens in the second half

Election Results 2024: Sensex Crash Live Updates: Andrew Holland, CEO of Avendus Capital Public Markets Alternate Strategies, said market confidence following the exit polls was also based on fairly accurate forecasts over the past two decades, except for the 2004 Lok Sabha elections. “That confidence was shaken in the first half on Tuesday,” Holland said. “We’ll wait and see what happens in the second half.”

Election Results 2024 Sensex Crash Live Updates: Sun Pharma submits marketing authorization application to EMA for experimental treatment of domestic, fully resectable melanoma drug Nidelgei

Election Results 2024 Sensex Crash Live Updates: Philogene and Sun Pharma today announced the submission of a marketing authorization application to the European Medicines Agency (EMA) for the approval of Nidelgei, an investigational neoadjuvant (i.e. preoperative) treatment for locally advanced fully resectable skin cancer.

If approved, Nidelji will become the first immunostimulant product to receive marketing authorisation, the company said in a stock exchange filing.

Niddelji is given intravenously for up to 4 weeks and works to strengthen the immune system against tumour lesions, the company said.

Election Results 2024 Stock Market Impact Live: Reliance Industries signs subcontract