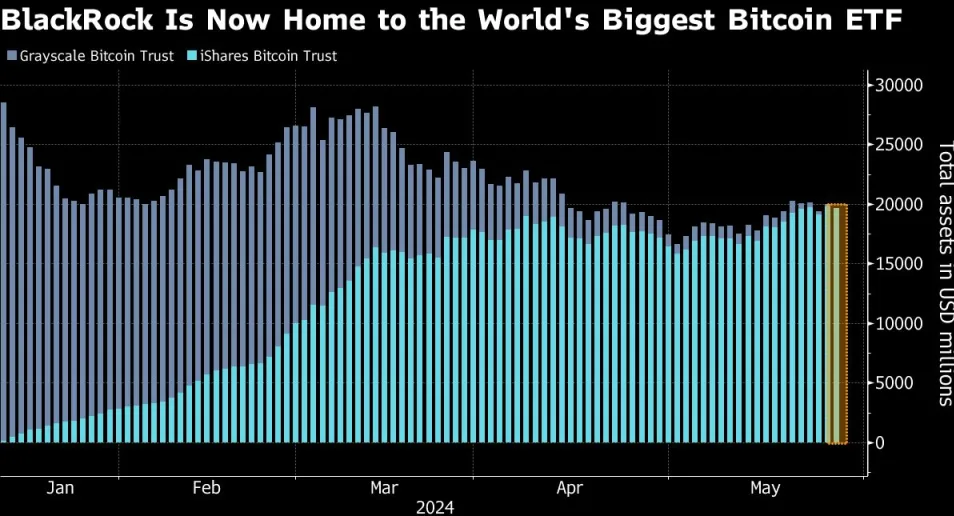

The World’s Biggest Bitcoin Fund Is Currently BlackRock’s $20 Billion ETF.

Ever since it debuted in the US at the beginning of the year, BlackRock Inc.’s iShares Bitcoin Trust has grown to become the largest cryptocurrency fund globally.

Bloomberg’s Most Read:-

After a Century, Wall Street Resumes Trading T+1 Stocks.

Treasuries Plunge as US Sales Fail to Draw in Customers: Markets Close.

$1 million a year is insufficient for the best talent at Private Credit.

Tensions are raised by an Israeli airstrike and the death of an Egyptian guard.

Mortgages at 7% Force a Quick Reevaluation of the American Dream.

According to data collated by Bloomberg, the exchange-traded fund held $19.68 billion of the token on Tuesday, overtaking the $19.65 billion Grayscale Bitcoin Trust. Fidelity Investments’ $11.1 billion offering is the third largest.

The over ten-year-old Grayscale vehicle was transformed into an ETF on January 11, the same day as nine Bitcoin ETFs, including those from BlackRock and Fidelity, debuted. The token’s rise to a record $73,798 by March was sparked by the launches, which marked a turning point for the cryptocurrency industry by making Bitcoin more accessible to investors.

Since the fund’s launch, investors have withdrawn $17.7 billion from the Grayscale fund, whereas the iShares Bitcoin Trust has received the most inflow of $16.5 billion. Arbitragers’ departures and the latter’s increased fees have been mentioned as potential causes of outflows.

Requests for comment made outside of usual US business hours were not immediately answered by Grayscale Investments LLC or BlackRock. A person familiar with the situation stated in March that Grayscale plans to start a clone of its main fund and that lower fees are anticipated. This information was based on a regulatory file that the company made.

In January of 2023, the Securities and Exchange Commission reluctantly approved the first US spot-Bitcoin exchange-traded funds (ETFs) after a court ruling in favour of Grayscale.

The company established the largest vehicle of its kind, the Grayscale Bitcoin Trust, in 2013. However, Grayscale pressed for an ETF conversion to guarantee parity in trading after discovering that shares of the closed-ended product occasionally traded at significant premiums or discounts to its net asset value.

SEC Turnaround:-

Surprisingly, the SEC changed its mind last week and decided to approve ETFs for Ether, a token with a market value second only to Bitcoin. After a string of scandals, the agency, led by Chair Gary Gensler, has doubts about the cryptocurrency sector as a whole.

With $58.5 billion in assets as of right now, the Bitcoin fund family has been praised as one of the most prosperous new ETF categories. However, detractors contend that even in ETFs, erratic digital assets are not well suited for broad adoption.