Equity bulls are likely to have a field day on Monday after exit polls predicted a thumping majority for the ruling Bharatiya Janata Party (BJP) in the Lok Sabha elections. This prediction has come as a relief, given how the markets have been marred by election jitters throughout May.

BJP Seat Wins: Boosting Market Sentiment

While India Today-Axis My India exit poll results are still unfolding, almost all other exit polls predicted the BJP-led NDA’s seat wins in the 350-400 range. This is largely in line with opinion polls released last month. A favorable market reaction is likely on Monday, as the stock market had, over the last six weeks, lowered expectations on BJP or NDA seat counts following lower turnout in the first few phases of Lok Sabha elections 2024.

A Business Today Markets survey of stock analysts suggested the stock market was pricing in 300-320 seats for NDA, with the Phalodi Satta Bazar indicating 300 seat wins for NDA. The exit poll results, therefore, are far better than those expectations.

“Markets should react very positively. A 350-plus seat win on Judgement Day would be a very strong number. I would say Nifty would be able to sustain the level of 22,500. From here onwards, there would only be upside, not downside. The Nifty level of 22,500 would be the base,” said Kranthi Bathini, Director of Equity Strategy at WealthMills Securities.

Historical Significance and Market Outlook

On Narendra Modi, Bathini noted that an incumbent Prime Minister coming back to power for the third time is rare in India, considering it a ‘historical’ outcome.

“350-400 seats was what the market was originally expecting for NDA, which is why the market looked strong initially. But there were noises recently suggesting the NDA seat count could come closer to 300 and that is why there were some jitters. But in the last two days, the feeling was like that’s not the case. The exit poll projects suggest things will be better for markets in the coming week,” said Amar Ambani of YES Securities.

Ambani added that once the political clarity is there, Foreign Portfolio Investors (FPIs) who follow global press might soon bring in dollars into domestic equities.

“Absolutely, the market would surely welcome the exit poll numbers on Monday. Maybe, we may see a little bit of nervousness because 400-plus was what was spoken about by Prime Minister Narendra Modi and the BJP-led alliance. Now, we will have to wait for the actual numbers on June 4,” said Gaurang Shah of Geojit Financial Services.

Exit Poll Predictions and Market Reactions

Jan Ki Baat sees NDA wins at 377. India News D-Dynamics predicts 371, Republic Bharat-Matrize at 353-368, Republic TV – P MARQ at 359, and TV 5 Telugu at 359 seats.

“Exit polls & final election results happen every five years. These events create near-term volatility, but markets are mature enough to shrug them off and move on. Finally, fundamentals & earnings growth of the companies will continue to determine market trends,” said Aniruddha Naha, CIO – Alternatives, PGIM India AMC.

Future Market Movements and Technical Levels

Opinion polls earlier suggested 370-410 seats for the BJP-led NDA. India TV-CNX suggested 399 seats, ABP News-CVoter 373, ZEE News 390, News18 411, with an average expected seat wins for the four opinion polls at 393.

Lower voter turnout had earlier hit market sentiment. The sentiment improved after Union home minister Amit Shah and Prime Minister Narendra Modi in separate interviews expressed confidence in a strong mandate. Ahead of the seventh phase of polling, FM Nirmala Sitharaman also recently mentioned that a mandate for BJP could send stocks into a ‘solid bull market.’

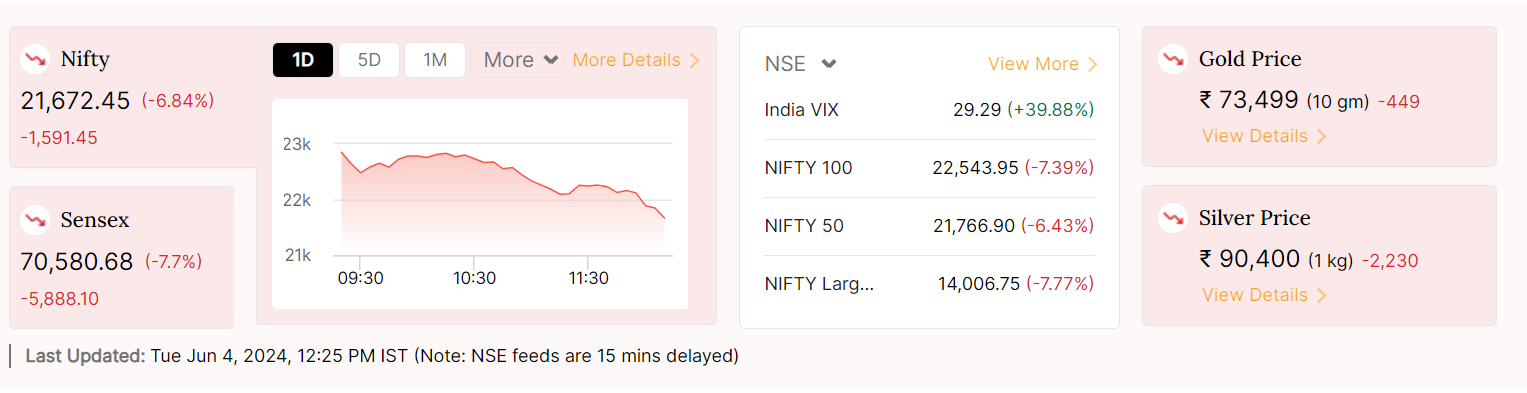

On June 4, Arvinder Singh Nanda of Master Capital Service noted the possibility of profit booking in the second half of the trading session following an initial upward movement.

“Historical trends from the previous two election outcomes in 2014 and 2019 have shown similar patterns, where the market closed with minimal change after experiencing significant volatility during the early trading hours. From a technical perspective, the 22,400 level, near the 50-day EMA, is critical on the downside, while the 23,400 level will be crucial on the higher side,” he said.

Key Takeaways

- BJP Victory Predictions: Exit polls suggest a BJP-led NDA majority, boosting market optimism.

- Market Reactions: Positive reaction expected, with potential for Nifty to sustain 22,500 levels.

- Historical Significance: Modi’s third term could mark a historic event, driving further market confidence.

- Future Outlook: Technical levels to watch: 22,400 on the downside, 23,400 on the upside.

With these insights, investors can better anticipate market movements and make informed decisions as the official election results unfold.